About Housing Finance Authority The Alachua County Housing Finance Authority (the

“Authority”) is a public body corporate and politic of the State of Florida,

created in accordance with Chapter 159, Part IV, Florida Statutes (the “Act”).

Pursuant to the Act, the Board of County Commissioners of Alachua County,

Florida (the “BOCC”) created the Authority by Ordinance 81.07, as amended,

99.25, now codified Chapter 32 et seq. of the Alachua County Code of

Ordinances (the “Ordinance”).

The Housing Finance

Authority of Alachua County, Florida (the HFA) provides tax exempt and taxable

financing for the acquisition, construction, and/or rehabilitation of

multi-family rental housing projects which satisfy the goals and requirements

of the HFA, and comply with applicable federal and state law. In any given

year, the ability of the HFA to provide tax-exempt financing for projects is

contingent upon receipt by the HFA of an annual tax-exempt bond allocation from

the Division of Bond Finance of the State of Florida (the Division).

The

Housing Finance Authority (HFA) is a five (5) member board. The HFA receives

revenue in the form of fees from the sale of tax bonds, program participation

fees and lien payoffs from housing projects.

The HFA encourages

investment by private enterprise and stimulates construction and rehabilitation

of housing through use of public financing.

True Notice of Funding Availability True Mission The mission of the HFA is to consider

opportunities that increase the availability of affordable housing in Alachua

County. The Authority issues tax exempt bonds for the development or

acquisition and rehabilitation of multifamily rental housing complexes and

loans for the development of affordable housing. Owners of such facilities are

required to set aside a portion of the units for lower income persons and

families.

False Bonds The

Alachua County Board of County Commissioners has final approval for all

bond transactions.

Any

bonds to be issued and sold by the HFA on the negotiated basis authorized in

Sec. 159.613(2), FS, 1979, shall first be approved by resolution of the BOCC,

both as to the documents and the method of sale by the HFA.

Any

rules or regulations to be promulgated by the HFA setting forth standards or

criteria for determining "eligible persons" in the program shall be

submitted to and approved by the BOCC prior to implementation.

The HFA

has the sole right to select the projects it wishes to finance. The HFA may, in

its sole discretion, waive specific provisions of these Bond Policies if doing

so is determined to be in the best interest of the HFA, or is determined to be

in furtherance of its stated goals or objectives. Furthermore, the HFA may, at

any time, amend, revise or repeal its policies, including all or any portion of

these Bond Policies, with or without notice, and the HFA reserves the right to

impose additional requirements on a particular project. False How to Qualify for a Bond Project To qualify as a new project under these Bond Policies, a project may be (i) a proposed multifamily development for which the HFA financing will be used for new construction, or (ii) an existing multifamily development for which the HFA financing will be used for acquisition and substantial rehabilitation. To qualify for bond financing through the HFA, new projects must, at a minimum, meet the following requirements:

1. The project must be located in an area of Alachua County. 2. The project may be developed and owned by either a for-profit developer, a non-profit developer, or a governmental entity. 3. The project (and those associated therewith) must comply with all applicable federal laws, rules and regulations, as amended, including, but not limited to, the Internal Revenue Code of 1986, as amended (the Tax Code), and the regulations promulgated thereunder. 4. Developers will be required to comply with all disclosure requirements promulgated by the Securities Exchange Commission and/or the Municipal Securities Rulemaking Board.

Projects developed and owned by non-profit developers must comply with all applicable federal laws, rules and regulations, as amended, including but not limited to, Section 142(d) of the Tax Code. Projects developed and owned by non-profit developers must comply with all applicable federal laws, rules and regulations, as amended, including but not limited to, Section 501(c)(3) of the Tax Code.

To obtain copies of the documents listed below, please contact the Alachua County Housing Program at 352-337-6240 or by email at housing@alachuacounty.us. False Links False HFA Meeting Schedule Housing

Finance Authority (HFA):

HFA Zoom Link

(The second Wednesday of each month.)

Jan 11, 2023, 3pm-4pm, CSS Conference Room D

Mar 8, 2023, 3pm-4pm, CSS Conference Room D

May 10, 2023, 3pm-4pm, CSS Conference Room D

Jul 12, 2023, 3pm-4pm, CSS Conference Room D

Sep 13, 2023, 3pm-4pm, CSS Conference Room D

Nov 8, 2023, 3pm-4pm, CSS Conference Room D False Housing Finance Authority Board Positions/Members:

- Citizen-at-Large - Davin D. Woody, Chair

- Citizen-at-Large (knowledgeable in labor, finance or commerce): Genile L. Morris, Vice-Chair

- Citizen-at-Large (knowledgeable in labor, finance or commerce): Michelle Beans, Secretary

- Citizen-at-Large (knowledgeable in labor, finance or commerce): Kip Harrison, Treasurer

- Citizen-at-Large - Corey J. Harris

False Public Hearing Notice & Tax Equity and Fiscal Responsibility Act (TEFRA) Hearing

November 9, 2022 at 3:00 p.m., or thereafter, at Community Support Services, Housing, Conference Room D, 218

SE 24th Street Gainesville, Florida 32641.

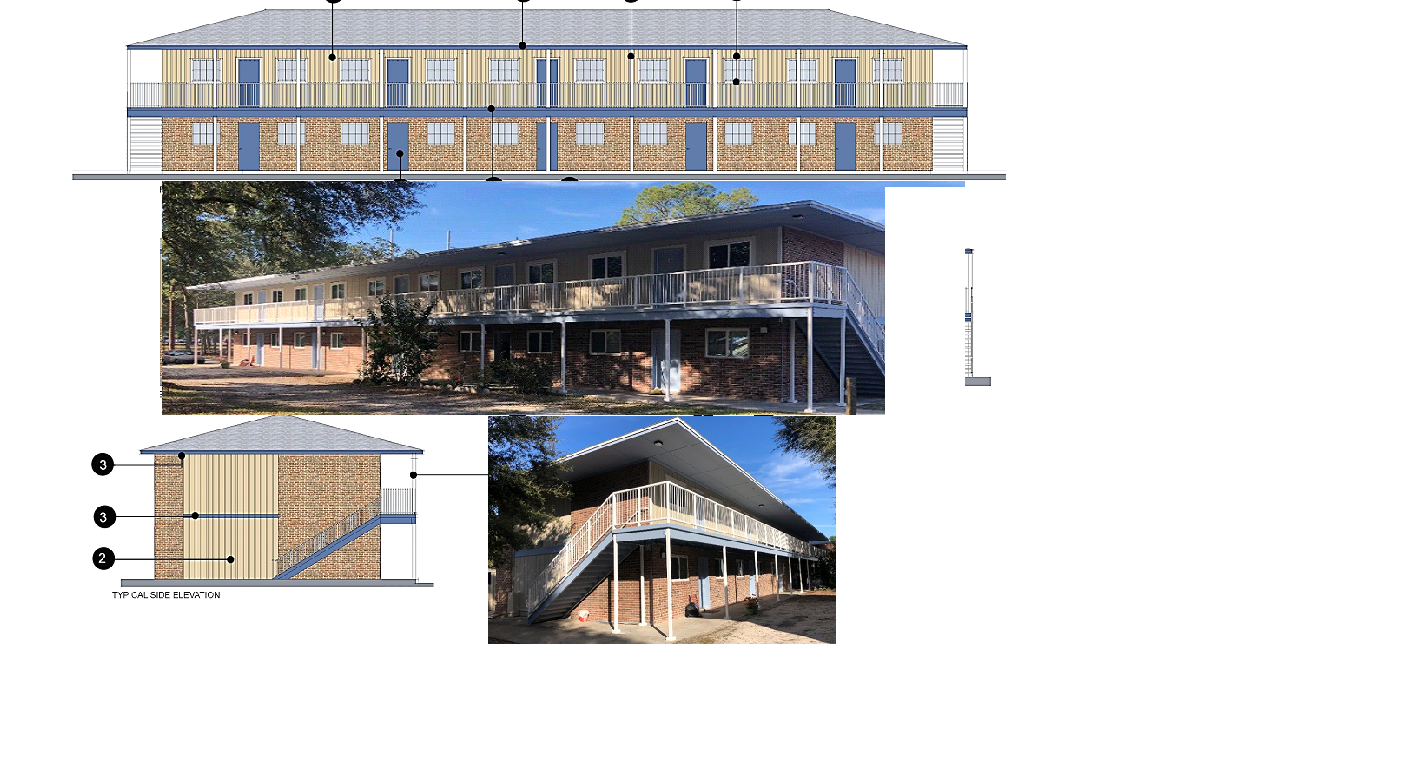

False Matching Funding RFA 2021-201 False Housing Finance Authority Projects Forest & Village Apartments

Since the Forest & Village Apartments transaction was closed at the end of May 2020, significant progress on multiple fronts has been made at the property. The below is a summary of updates between January and March 2021.

Renovations

- Construction commenced in July 2020 and is 55% complete as of February 28, 2021.

- As of today, apartments in 10 of the 20 residential buildings have

completed in-unit work(new kitchens, bathrooms, flooring, appliances,

etc.) and received sign-offs fromGainesville

- Exterior painting of the building has begun (a photo of the first painted building is attached)

- Site and grounds improvements are in progress.

- Replacement and enhancement of the existing security cameras will take place inApril/May 2021

- We are waiting to hear back from GRU on the upgrading of site lighting

Property Management

- Active marketing efforts online have begun to attract new

residents to lease up the renovated units and the property’s waitlist

has been open since early February 2021

Project Schedule

- 100% construction completion of the project is projected for summer 2021

Next Steps:

Fairstead will be eager to organize a ribbon-cutting or open house ceremony at Forest & Village Apartments

in late summer 2021 when the project has completed construction in the

anticipation that itwill be safe to gather again.

We are very thankful and appreciative of the support that the ACHFA

staff and board has extended to the project and look forward to meeting

in person again.

Sweet Water Ribbon Cutting - 2022

False

|

|